Most Popular

This Week

I no longer work in porn films: Sunny Leone

Sunny Leone, the Indo-Canadian porn star has struck gold in Bollywood. She has not just carved her niche as a budding actress of B-town b...

Fire breaks out at on the sets of Comedy Nights With Kapil in Goregaon Filmcity; no casualties reported

The extent of damage and cause of the fire are yet to be ascertained. ...

Popular Posts

Latest Stories

What is new?

Comments

What They says?

Gadget Review

Stock Watch

Tip: Don't Withdraw Fixed Deposits Prematurely | Check Reason.

In order to maximise returns, while it is useful to get high interest rates, it is also a good idea to minimise the cost of unplanned FD closure. Often, when we are need of funds, we tend towards breaking the fixed deposit. As a result we not only we lose on interest rates, but are also penalised as much as 1 per cent in the name of premature withdrawal penalty.

While this may seem a small number, it becomes sizeable when actual cost is calculated. Most banks calculate interest rates for premature closure of FDs by the following formula:

Interest Rates for Premature withdrawal of FDs = Interest Rate applicable for actual period of FD as per the rates prevalent at the time of investment - 1 per cent

Most of the banks charge premature withdrawal penalty as per the above formula for all fixed deposits, including linked FDs with sweep in facility and FDs with periodic interest payouts.

In case of FDs with periodic interest payouts, where banks have already paid the investor interest as per the committed rates, banks calculate the applicable penalty at the time of redemption, and reduce the final payout by the same effectively reducing the interest rate to the rate as per the above formula.

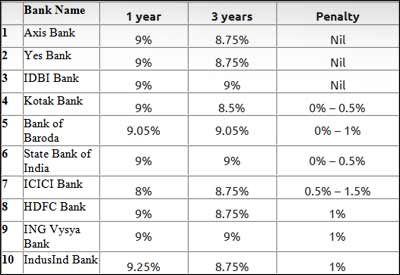

However, the premature withdrawal penalty can be completely avoided as several banks have started offering premature withdrawal without penalty. In fact, you will be surprised to know that some of them also offer the best interest rates on FD's. The following table lists interest rates offered on FDs and premature withdrawal penalties levied by major banks:

The above comparative shows that Axis Bank, Yes Bank and IDBI Bank offer high interest rates and also allow premature withdrawal without penalty.

On the other hand, major retail banks like ICICI Bank and HDFC Bank offer lower interest rates and charge hefty premature closure penalties.

Let us take an example where Ajay has invested Rs. 3 lakh each in Axis Bank and HDFC Bank for a period of 3 years but withdraws the money in 1 year. The following is the return Ajay gets from both FDs:

While both the FDs are offering same returns for 3 year period and the interest rate applicable for 1 year is also same in both the cases, Ajay loses out Rs. 3,479 only due to penalty in case of HDFC Bank.

One might think about the case where FD rates are lower for the actual deposit period than the original period; and the case where FD rates at the time of booking were higher than rates prevailing at the time of FD closure. In such cases, banks take the lower of the two rates to pay interest.

So, next time when you book your FD, do not forget to check the premature withdrawal penalty along with interest rates, else you may land up losing out on easy money

About Hemant Verma

Adds a short author bio after every single post on your blog. Also, It's mainly a matter of keeping lists of possible information, and then figuring out what is relevant to a particular editor's needs.

Labels

Aamir Khan

(3)

Amitabh Bachan

(1)

Android

(1)

Apple

(2)

Application

(2)

Assembly Voting

(6)

Awards

(1)

Blackberry

(1)

Bollywood

(9)

Business

(15)

Cancer

(1)

Commodity

(2)

Cricket

(3)

Crime

(4)

Delhi

(2)

Delhi Poll Agenda

(6)

Economy

(7)

Education

(1)

Entertainment

(12)

Exit Poll

(4)

Facebook

(3)

Gadget

(11)

Gold

(3)

Google

(4)

Goverment

(4)

Health

(2)

Hollywood

(1)

India

(3)

Interview

(1)

iPhone

(3)

IPL

(2)

LifeStyle

(1)

Mahindra & Mahindra

(1)

Market

(1)

Maruti Suzuki

(1)

Microsoft

(2)

Mobile

(2)

Money

(2)

Obama

(1)

Politics

(7)

RBI

(1)

Result Assembly Election

(2)

Rupee-Dollar

(3)

Samsung

(2)

Scam

(2)

Science

(1)

Sensex

(2)

Silver

(1)

Skype

(1)

Social Media

(8)

Space

(1)

Sports

(5)

Tablet

(2)

Tax

(2)

Technology

(40)

Twitter

(1)

US

(2)

World

(5)

Your Money

(3)

No comments: