Most Popular

This Week

Review of Apple's iOS 7 | Take a Look of Technology

Apple's iOS 7 is finally here, and the update is an exciting one for many as it's the biggest update the firm has released since t...

Sensex hits new record on BJP win; rupee at 4-month high

The BSE Sensex surged as much as 487 points to a record high of 21,483.74, while the 50-share Nifty...

Popular Posts

Latest Stories

What is new?

Comments

What They says?

Gadget Review

Stock Watch

Business, Commodity, Gold, Technology

विदेशों में बहुमूल्य धातुओं की कीमतों में तेजी का रुख देखते हुए सटोरियों ने अपने सौदों के आकार को बढ़ाया जिससे वायदा कारोबार में बुधवार को सोने का भाव 186 रुपये की तेजी के साथ 27,165 रुपये प्रति 10 ग्राम हो गया. वहीं चांदी की कीमत भी 248 रुपये की तेजी के साथ 37,520 रुपये प्रति किलोग्राम हो गई.

एमसीएक्स में सोने के दिसंबर डिलीवरी वाले अनुबंध के भाव 186 रुपये अथवा 0.69 प्रतिशत की तेजी के साथ 27,165 रुपये प्रति 10 ग्राम हो गए जिसमें 836 लॉट के लिए कारोबार हुआ. एमसीएक्स में चांदी के दिसंबर डिलीवरी वाले अनुबंध की कीमत 248 रुपये या 0.67 प्रतिशत की तेजी के साथ 37,520 रुपये प्रति किलो ग्राम हो गई जिसमें 827 लॉट के लिए कारोबार हुआ.

बाजार विश्लेषकों ने कहा कि निवेशकों को अमेरिकी फेडरल रिजर्व द्वारा इस वर्ष ब्याज दर में वृद्धि की कमजोर संभावना दिखाई दे रही है और इसकी वजह से मजबूत वैश्विक रुख को देखते हुए सटोरियों ने अपने सौदों के आकार को बढ़ाया जिससे वायदा कारोबार में सोने-चांदी की कीमतों में तेजी आई.

Gadget, Technology

Sony has launched a pair of smart glasses, just as Google is deciding what to do with its own connected eyewear.

The Smart Eyeglass, made by Sony, will be available from March 10 in the UK as well as Japan, Germany and the US. It will cost €670.

Sony’s launch comes weeks after Google halted sales of Glass, taking the product out of its experimental stage but making no clear commitment to start re-selling it. Glass’s cancellation came amid much speculation about whether consumers would ever take to smart glasses worn on the face.

Sony’s glasses offer much the same features as Google’s. They connect with Android smartphones, and the show text, images and information on a small built-in screen, superimposed over the real view.

They are built into a slightly less obvious pair of glasses. Where Google’s eyewear had much of the computer components built into a box on the side of the frame, Sony’s glasses are bigger and wraparound the face.

The company will release a new version of its kit that allows software developers to make apps for the glasses.

As well as displaying images and texts, apps can receive information from the phone such as geographical location and inputs.

Developers have made a range of apps for Google Glass — mostly using the screen as a way of displaying notifications, similar to smart watches — but development has mostly lagged behind expectations as the glasses have failed to take off.

The Smart Eyeglass, made by Sony, will be available from March 10 in the UK as well as Japan, Germany and the US. It will cost €670.

Sony’s launch comes weeks after Google halted sales of Glass, taking the product out of its experimental stage but making no clear commitment to start re-selling it. Glass’s cancellation came amid much speculation about whether consumers would ever take to smart glasses worn on the face.

Sony’s glasses offer much the same features as Google’s. They connect with Android smartphones, and the show text, images and information on a small built-in screen, superimposed over the real view.

They are built into a slightly less obvious pair of glasses. Where Google’s eyewear had much of the computer components built into a box on the side of the frame, Sony’s glasses are bigger and wraparound the face.

The company will release a new version of its kit that allows software developers to make apps for the glasses.

As well as displaying images and texts, apps can receive information from the phone such as geographical location and inputs.

Developers have made a range of apps for Google Glass — mostly using the screen as a way of displaying notifications, similar to smart watches — but development has mostly lagged behind expectations as the glasses have failed to take off.

Education, Technology

IIT Kanpur Placement 2013

IT giant Oracle has offered a remuneration package of Rs 1.3 crore per annum to three students while internet giant Google has offered an annual package of Rs 1 crore to six students. LinkedIn has offered an annual package of Rs 1 crore to two students while Tower Research has given one student a package of Rs 1 crore per annum, a top official said, requesting anonymity.

The number of students to have bagged a placement offer of Rs 1 crore or above is expected to increase three-fold as out of 250 companies, only 90 have participated in the placement drive till now, the official said.He also dismissed reports that the three students being given Rs 1.3 crore per annum have refused the offer.

There are dozens of students have bagged a package between Rs 50 to Rs 75 lakhs per annum, the official said.

IIT Kanpur placement cell incharge Vimal Kumar said around 1,100 BTech, MTech, MBA and MSc students registered for the placement process out of which 350 students have received their offer letters.He refused to give details of the package but said the students are getting good offers.

As many as 50 multi-national companies and 40 Indian companies have participated in the placement procedure.Mulit-national companies that have participated in the placement procedure so far include Mitsubishi, Amazon, Citibank, Microsoft, Sony, Samsung, Airbus, HSBC Bank, Deutsche Bank, Credit Switch and others, Kumar said.

Indian companies that participated in the placement drive include Tata motors, ITC, Flipkart, Infosys and Hero motors.

The drive that started on Sunday would continue till December 22.The IIT administration has also organized a special workshop to train students for facing interviews.

Tax, Your Money

Any salaried person would have heard of a term called HRA (House Rent Allowance). It not only gives benefit in the form of allowance but also gives an opportunity for tax exemption up to a certain limit. Almost every salaried employee takes this benefit. IT department also provides the facility of claiming tax benefit on HRA for rent paid to parents.

HRA exemption can be availed up to least of the following:

1) Actual HRA received.

2) Excess of rent paid over 10% of the salary.

3) 50% of salary if house is located in Delhi, Mumbai, Kolkata or Chennai. 40% elsewhere.

Change in Rule

Until now, tax payers did not have to provide landlord’s PAN unless the rent was Rs. 1,80,000 p.a or Rs. 15,000 per month. However, IT department has put its foot forward in this regard and lowered the limit to declare landlord PAN to Rs. 1 lakh p.a or Rs. 8,333 per month. The reason IT department has brought about this new rule is because it believes there are a lot of fake receipts being submitted while claiming HRA exemption.

Landlord needs to report Income

The landlord has to report this income while filing his tax returns. If there is a discrepancy in reporting this income, he/she would face the consequences. Hence, people who are reporting to have paid rent to their parents for the purpose of HRA exemption need to be even more cautious now as they have to declare their parents PAN if rent crosses Rs.1 lakh p.a.

Exemption for Rent Receipts

However, employees who receive HRA up to Rs. 3,000 per month are not required to submit receipts for proof of rent paid. It may not benefit huge number of tax payers, though. This concession is only for the purpose of TDS (Tax Deduction at Source), and, in the regular assessment of the employee, the Assessing Officer will be free to make such enquiry as he deems fit for the purpose of satisfying himself that the employee has incurred actual expenditure on payment of rent.

If Landlord does not have PAN

In case the landlord does not have PAN, employee should submit a declaration stating the same along with the landlord’s details. The new rule is set to trouble the tax payers more as we know that a lot of landlords would be unwilling to submit PAN details or even give a declaration.

What if documents are not submitted?

The documents need to reach the IT department within February month of next calendar year. If it’s not the case, the HRA exemption given will be reversed and the entire HRA amount will be clubbed with the salary and taxed according to the tax slab.

This new rule is definitely a set back for a lot of salaried people since there were many of those who were claiming HRA exemption even without paying rents. But, even the honest tax payers would be hit hard on account of this new rule because of the reluctance of landlords to neither submit PAN nor give a declaration.

Business, Tax, Your Money

The Income Tax Calculator is quite popular among those who are employed and liable to pay taxes. It is also popularly known as Tax Calculator. Such Income Tax Calculators are used by major tax filing portals, personal finance companies. InvestmentYogi provides a very simple calculator for calculating the individual tax liability for the particular assessment year.

Why should you use this calculator?

If you want to know how much tax you would have to pay for the income generated in the year, this calculator is the one for you.

How to use this calculator?

The entries to make are:

Assessment Year – Choose the assessment year for which you want to know the tax liability. Ex: AY 2014-15, AY 2013-14, etc. AY 2014-15 is also known as FY 2013-14.

Income of Individual as – Choose under what status you are filing the taxes i.e. male, female or senior citizen. Tax slabs are different for few categories depending on year of assessment.

Gross Salary – It is the total salary including bonus, perquisites, compensation, etc.

Section 10 Exemptions – There are a lot of exemptions available for the employees depending on the company such as HRA, LTA, Medical, Petrol, Telephone, etc. The total of these exemptions needs to be entered here.

Section 16 Deductions – Section 16 allows a deduction for professional tax /tax on employment, entertainment. The total of such deductions for the year can be entered here.

Other Sources Income – Enter the other sources of income such as family pension, interest income from FD’s and other investments.

Chapter VIA Deductions – Deductions from Section 80C – 80U such as PF, Insurance premium, Donations, etc. Remember that each section has its own limit, like 80C limit is 1 lakh.

Once you enter these values and click on calculate, the result would be stating the total tax liability including education cess and surcharge (if applicable).

When should you use this Calculator?

This calculator is to be used when you are unsure of your tax liability or want to recheck the tax liability for the assessment year concerned.

Can it be used in any other situation?

This is specifically used when looking for calculating the income tax to be paid or being paid. It is also useful when there is a refund involved and you are eager to know how much it would be.

Business, Technology, Your Money

In order to maximise returns, while it is useful to get high interest rates, it is also a good idea to minimise the cost of unplanned FD closure. Often, when we are need of funds, we tend towards breaking the fixed deposit. As a result we not only we lose on interest rates, but are also penalised as much as 1 per cent in the name of premature withdrawal penalty.

While this may seem a small number, it becomes sizeable when actual cost is calculated. Most banks calculate interest rates for premature closure of FDs by the following formula:

Interest Rates for Premature withdrawal of FDs = Interest Rate applicable for actual period of FD as per the rates prevalent at the time of investment - 1 per cent

Most of the banks charge premature withdrawal penalty as per the above formula for all fixed deposits, including linked FDs with sweep in facility and FDs with periodic interest payouts.

In case of FDs with periodic interest payouts, where banks have already paid the investor interest as per the committed rates, banks calculate the applicable penalty at the time of redemption, and reduce the final payout by the same effectively reducing the interest rate to the rate as per the above formula.

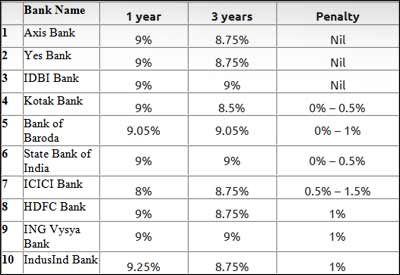

However, the premature withdrawal penalty can be completely avoided as several banks have started offering premature withdrawal without penalty. In fact, you will be surprised to know that some of them also offer the best interest rates on FD's. The following table lists interest rates offered on FDs and premature withdrawal penalties levied by major banks:

The above comparative shows that Axis Bank, Yes Bank and IDBI Bank offer high interest rates and also allow premature withdrawal without penalty.

On the other hand, major retail banks like ICICI Bank and HDFC Bank offer lower interest rates and charge hefty premature closure penalties.

Let us take an example where Ajay has invested Rs. 3 lakh each in Axis Bank and HDFC Bank for a period of 3 years but withdraws the money in 1 year. The following is the return Ajay gets from both FDs:

While both the FDs are offering same returns for 3 year period and the interest rate applicable for 1 year is also same in both the cases, Ajay loses out Rs. 3,479 only due to penalty in case of HDFC Bank.

One might think about the case where FD rates are lower for the actual deposit period than the original period; and the case where FD rates at the time of booking were higher than rates prevailing at the time of FD closure. In such cases, banks take the lower of the two rates to pay interest.

So, next time when you book your FD, do not forget to check the premature withdrawal penalty along with interest rates, else you may land up losing out on easy money

Business, Money, Rupee-Dollar, Technology

Besides, a higher opening in the domestic equity market, where the Sensex soared to an all-time high of 21,483.74 points after BJP’s victory in state Assembly elections and strengthening of other currencies against the dollar overseas, also supported the local currency, forex dealers said.

The rupee had gained 34 paise to close at five-week high of 61.41 against the dollar on Friday.

Labels

Aamir Khan

(3)

Amitabh Bachan

(1)

Android

(1)

Apple

(2)

Application

(2)

Assembly Voting

(6)

Awards

(1)

Blackberry

(1)

Bollywood

(9)

Business

(15)

Cancer

(1)

Commodity

(2)

Cricket

(3)

Crime

(4)

Delhi

(2)

Delhi Poll Agenda

(6)

Economy

(7)

Education

(1)

Entertainment

(12)

Exit Poll

(4)

Facebook

(3)

Gadget

(11)

Gold

(3)

Google

(4)

Goverment

(4)

Health

(2)

Hollywood

(1)

India

(3)

Interview

(1)

iPhone

(3)

IPL

(2)

LifeStyle

(1)

Mahindra & Mahindra

(1)

Market

(1)

Maruti Suzuki

(1)

Microsoft

(2)

Mobile

(2)

Money

(2)

Obama

(1)

Politics

(7)

RBI

(1)

Result Assembly Election

(2)

Rupee-Dollar

(3)

Samsung

(2)

Scam

(2)

Science

(1)

Sensex

(2)

Silver

(1)

Skype

(1)

Social Media

(8)

Space

(1)

Sports

(5)

Tablet

(2)

Tax

(2)

Technology

(40)

Twitter

(1)

US

(2)

World

(5)

Your Money

(3)